Charitable Trust and Not-for-profit Investors

Equity Trustees understands the not-for-profit sector. We are a philanthropic funder of thousands of for-purpose organisations, while our core business as a trustee is inherently focused on the best interests of others. We assist not-for-profit organisations in their purpose to have a meaningful and positive impact on society.

Our asset management team provides investment management services to more than 1200 charitable entities, a range of foundations, and for-purpose organisations with total funds under management of $3.5 billion. We know how to best manage money on behalf of tax-exempt organisations who need long-term capital growth and reliable sources of regular income. Achieving financial sustainability and producing diverse revenue streams helps not-for-profit organisations implement strategies to fulfil their mission.

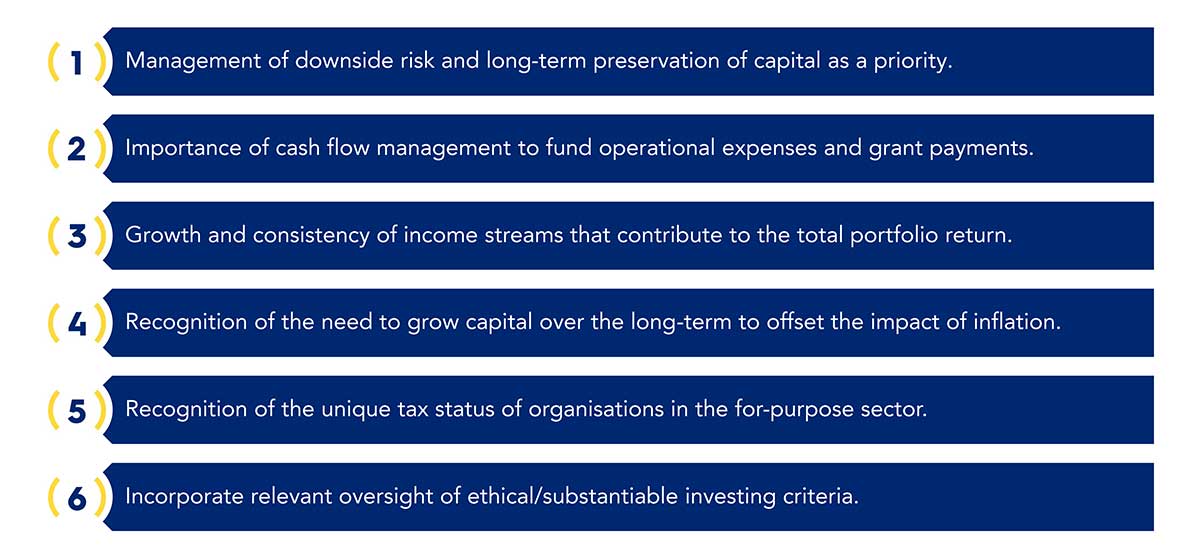

We understand the challenges the sector faces and provide solutions to help create more sustainable and impactful organisations. Our sector expertise delivers:

- Governance advice to fulfil Board fiduciary and Investment Committee responsibilities

- Investment strategies to achieve organisational objectives and build long-term financial sustainability

- Income to support NFPs’ grant, budget and program funding requirements.

- Solutions for responsible investing and ESG (Environmental, Social and Governance) objectives.

- Cost effective investment solutions and transparent, easy to understand fees.

- Values aligned with our clients, supporting the NFP sector’s long-term impact.

Partnership offering

Our relationship with clients is consultative and collaborative. We take the time to understand your needs and bring together our trustee, philanthropic and investment management services. This helps us determine the most effective strategy and asset allocation to meet your goals.

We offer a dedicated, proactive client relationship model that provides ongoing investment support. As a specialist asset manager, we can use our scale to consistently make efficient investment decisions and implement them at a low cost.

Our lasting partnerships with clients run deeply and are founded on the strong cultural alignment we have with the not-for-profit sector.

We are one of the largest sources of trustee philanthropic funding and bequests in Australia, distributing an average of more than $100 million a year. Our position as a trustee and leading provider of impact funding in Australia means we are privileged to make a positive social impact.

Not-for-profit investment strategy solutions

We have repeatedly seen that a well-structured investment management strategy helps grow an organisation’s corpus to build long term sustainability.