Responsible Investing

Our commitment to responsible investing

Equity Trustees has a deep commitment to responsible investing, which is closely aligned with our position as an independent trustee – a role that attracts the highest fiduciary standards of care. It is also aligned with our investment philosophy to preserve and grow the real value of capital over the long term.

We believe companies that demonstrate strong environmental, social and governance (ESG) practices tend have more sustainable and robust business operations. From a performance perspective, integrating ESG principles into investment analysis and decisions can help to enhance both the ability to generate attractive risk-adjusted returns, while driving positive social and environmental outcomes.

In achieving our purpose and fiduciary responsibilities, we believe we have a crucial role to play as stewards of our clients’ assets.

Our approach

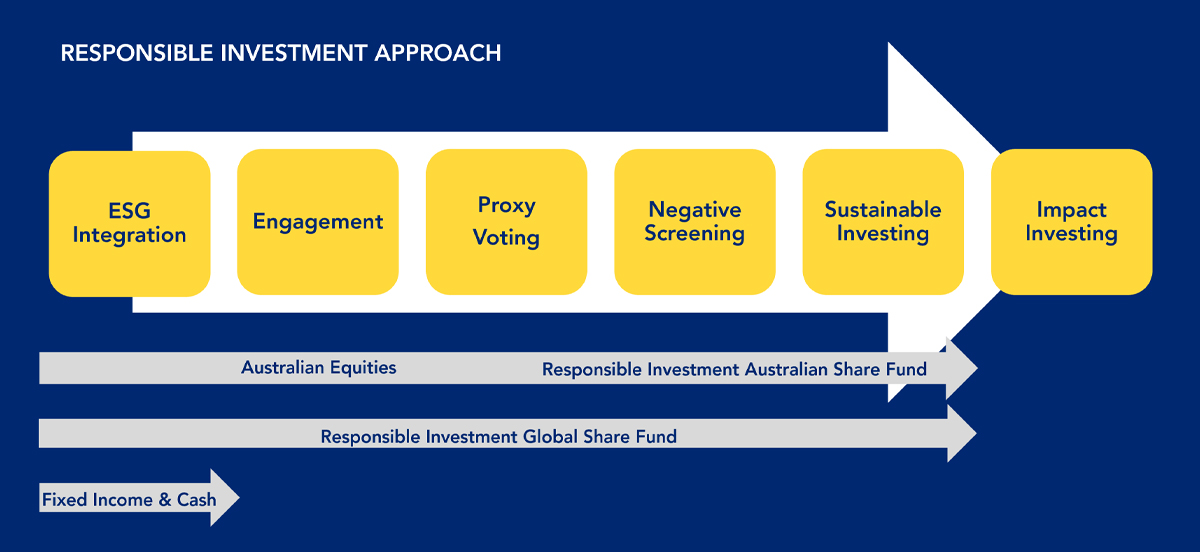

Our responsible investment framework is fully embedded into our investment and fund selection process across asset classes and delivered through a range of approaches spanning ESG integration, engagement with companies on ESG issues, exercising of our proxy voting rights, ethical investing, support for sustainable organisations and impact investing.

Our responsible investment approach is illustrated below:

Equity Trustees Asset Management is a proud member of the Responsible Investment Association Australasia (RIAA) and a signatory to the United Nations-supported Principals for Responsible Investment (PRI). As a PRI signatory, we report regularly on our responsible investing approach and are assessed on our implementation.

Our membership allows us to remain at the forefront of developments in the responsible investing sector. We continue to develop our approach to responsible investing across different asset classes as practices evolve.

You can read more about our responsible investment policy here.

| OUR RESPONSIBLE INVESTING FRAMEWORK |

|---|

| ESG Integration We identify, assess and integrate material ESG risks and opportunities in fundamental analysis and interactions with companies. ESG integration is applied across a range of our internally managed investment offerings, and forms a key component of our new investment manager selection process. We use specialist external research providers to inform our views. |