A smarter way to invest in global shares

Investing in global shares can drive portfolio returns and manage risk, here’s how.

The financial and mining stocks which dominate the Australian share market have delivered strong long-term returns. However, the companies which dominate the US share market are doing something more – they’re reshaping the world.

Disruptive technologies such as artificial intelligence (AI), cloud computing, innovative software, and cyber-security are driving global growth. Investors have been cashing in.

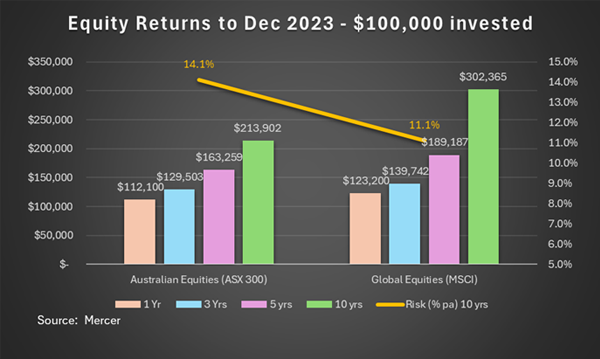

Household names such as Nvidia, Alphabet (Google), Meta Platforms (Facebook), Microsoft, Apple, and Amazon.com have helped international shares outperform Australian shares over the past one, three, five, and 10 years – and at lower volatility.

Accessing these markets in an efficient, low-cost manner has been the biggest challenge for investors.

A global market that includes thousands of investment opportunities

The global share market is best reflected in the MSCI ACWI ex-Australia (unhedged) Index.

It includes more than 2700 large and mid-cap stocks across 22 developed countries (excluding Australia) and 24 emerging market countries (source: MSCI). It forms a strong foundation for a diversified portfolio.

The 10 biggest Australian companies account for almost half (46 per cent) of the local share market while the 10 biggest global companies account for one-fifth (20 per cent) of the MSCI Index. So, concentration risk is actually lower internationally.

The opportunity is so large that investing directly in thousands of global stocks would be impossible for most investors. Instead, the most efficient way is through low-cost industry-based exchange-traded funds (ETFs), which track an underlying index.

There are now around 850 ETFs which hold about $US6 trillion in global assets, covering sectors such as semiconductors, technology, cybersecurity, medical devices, and robotics.

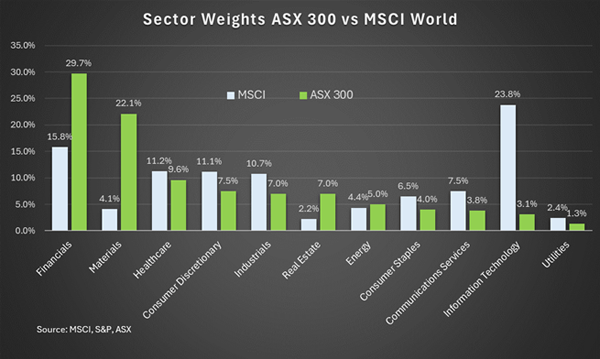

ETFs provide an important source of returns and diversification given the Australian share market has limited exposure to such growth industries.

The benefits of active management

Given the vast opportunity the global share market provides, there is ample opportunity to outperform the index.

Specialised ETFs offer a way to tilt portfolios towards sectors that offer better growth prospects than the broader economy. For example, investors can now select from more than 40 healthcare ETFs covering specialised sub-sectors such as medtech, pharma and genomics.

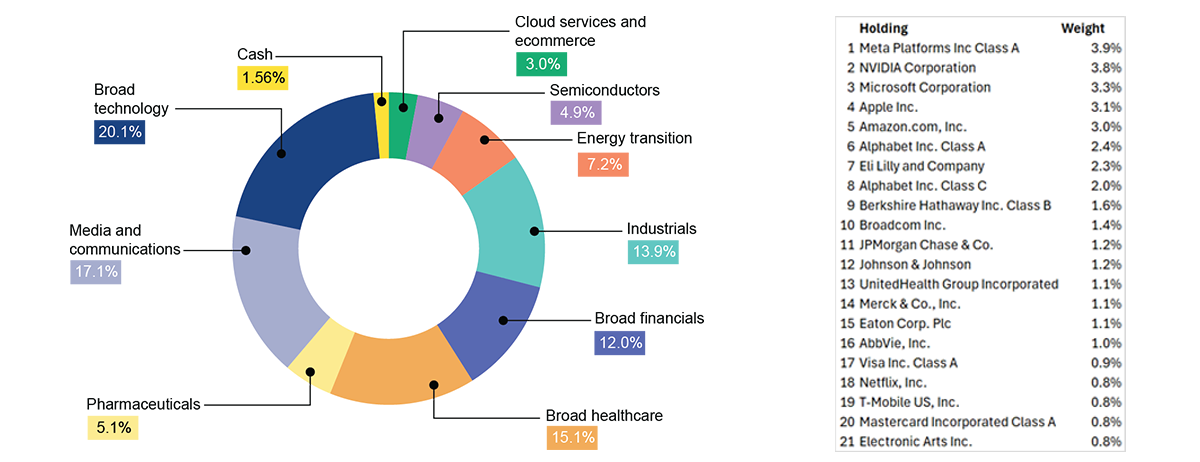

The EQT Eight Bays Global Fund uses this active ETF strategy to select a best-of-breed ETF portfolio that can be supplemented by holding up to 20 per cent of the portfolio in direct stocks listed on exchanges such as the New York Stock Exchange and NASDAQ if required.

Direct stocks can increase the portfolio’s exposure to attractive industries, add international diversification and add businesses not adequately represented in existing Industry based ETFS.

For example, the Fund recently invested directly in Amazon shares, giving the portfolio an overweight to the company whose combination of e commerce, cloud services and media businesses don’t comfortably fall into one industry vertical.

These types of active decisions can also be reflected through ETFs. The EQT Eight Bays Global Fund recently added the VanEck Pharmaceutical ETF (PPH) to its portfolio, boosting the allocation to global pharmaceutical companies already held in the broad Vanguard Healthcare ETF (VHT) (Source: Equity Trustees).

The EQT Eight Bays Global Fund aims to outperform the MSCI index by 2-3 per cent a year. It is designed for investors with a high-risk tolerance who want medium to long-term capital growth potential.

In this way, investors can add a new diversified source of returns by capturing the global trends that are changing the world.

To learn more about investing in global shares, subscribe to the EQT Eight Bays Global Fund quarterly performance reports,

or invest with us here