Monthly Market Summary July 2024

MARKET SUMMARY

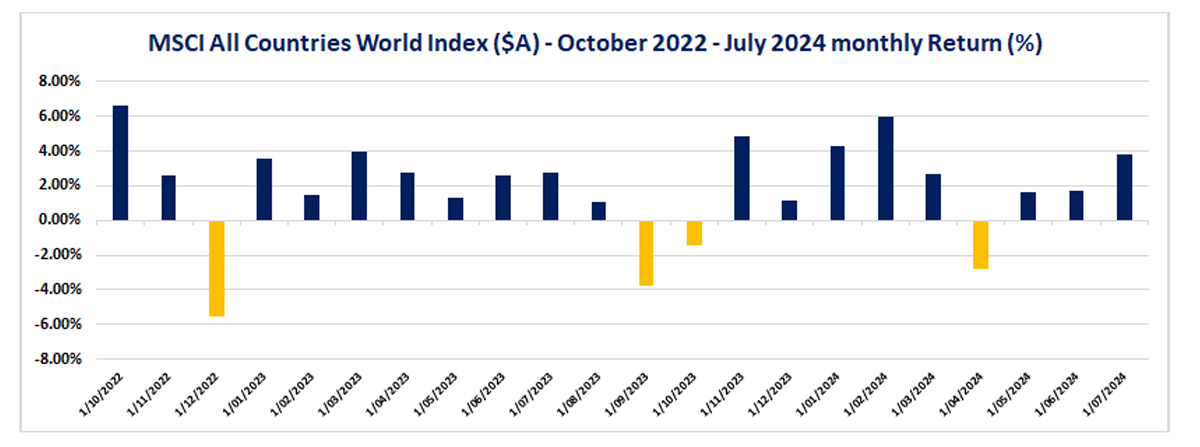

• Equities rose while witnessing sector rotation globally – Seasonally July is one of the best months of the year for Australian equity returns – and July 2024 continued that trend. There was plenty of news and reasonable volatility. A lower-than-expected inflation print spurred the ASX200, while the US market witnessed an unwinding of the “Magnificent-7” rally. In local currency terms, the ASX200 (+4.2%) outperformed the US S&P500 (+1.2%), the MSCI World ex Australia Index (+1.8%) and the MSCI Asia Pacific ex Japan Index (-0.2%). In AUD terms however, the MSCI World ex Australia Net Total Return Index rallied 4%. In the US market there was a rotation from the major technology stocks (Nasdaq -0.7%) to the broader market (Dow Jones +4.5% & small cap Russell 2000 +10.2%) in part due to heightened near term interest rate cut expectations but also the potential impact of a Trump-led government leading to de-regulation and China-protectionist tariffs (which weighed on Chinese exposures).

• ASX contributors – In Australia, the best performing sectors for the month (total returns) were Consumer Discretionary (+9.1%), Property (+6.8%) and Financials ex property (+6.3%) buoyed by an improved interest rate outlook following softer than expected inflation. The worst performers were Utilities (-2.9%), Energy (-0.4%) and Materials (-0.1%). Taking market capitalisation (size) into account, the major banks, CSL and Wesfarmers drove the market higher, while the miners dragged on the index.

• Banks vs Resources – Since the October 2023 lows, the ASX200 has rallied 22.5% with banks the primary contributor (~40% of gains). This calendar year in Australia, the Banks have outperformed Resources by 38.5%. Banks have benefited from their strong capital positions and better than expected domestic economic environment lowering bad debt assumptions. Conversely, Resources have been negatively impacted by the continued soft Chinese economic data and lack of new stimulus.Bank sector valuations have moved to all-time highs despite subdued profit growth expectations and falling Return on Equity.

• Bonds rallied – The Bloomberg AusBond Comp 0+Y rose 1.48%. US 10-year bond yields fell 37bp to 4.03%, while Australian 10-year bond yields fell 20bps to 4.12%. Lower than expected inflation in Australia and US drove the rally, while rising geopolitical tensions led to safe-haven buying in bonds. Shorter duration bond yields (eg 2 year) fell more than longer duration bonds leading to a steepening of the yield curve. The US yield curve has been inverted (a sign of future economic weakness) for a reasonable period but is now approaching positive territory. Credit markets (ex MBS) rose 1.56% with spreads slightly narrowing in the US and Australia.

• Australian Economic data – Toward the end of the month weaker than expected inflation (0.8% trimmed mean vs consensus +1% quarter-on-quarter) removed the risk of a near term rate hike with many economists now expecting the next move to be a cut in the first half of CY2025. This shift in interest rates views weighed on the AUD/USD which fell 1.9% to 65.42c. The unemployment rate (for June) ticked up to 4.1% from 4.0% with leading indicators pointing to further softening. Building approvals fell 6.5% and remain at low levels with high construction costs being a major headwind.

• US Politics. inflation and the Fed led to a rotation in stocks – Politics impacted markets in July with Joe Biden’s poor debate showing acting as a catalyst for the “Trump Trade”. Later in the month President Biden withdrew from the Presidential race with Kamala Harris taking over as the likely Democratic candidate. The US Federal Reserve kept rates unchanged at 5.5% but Fed Chair Jerome Powell’s dovish commentary and well-behaved inflation releases reaffirmed market expectations of rate cuts starting from later this year. June core CPI rose 0.1% month-on-month in June vs 0.2% (in May) and year-on-year measures fell to 3% (vs expectations of 3.3%). Non-farm payrolls continued to grow rising a solid 206k in June, however the unemployment rate increased slightly to 4.1% and future indicators continue to soften. The market is now pricing in five rate cuts in the US over the next 12 months commencing in September.

• Europe and China remain subdued – The European Central Banks left rates unchanged. European inflation unexpectedly rose in July to 2.6% yoy, while German and French business outlook indicators worsened. China’s 2Q GDP release was weaker than expected. Manufacturing sector numbers softened, consumption slowed and housing relating data remained weak. Incremental easing continued and was reaffirmed at the Chinese Politburo meeting, but the market seeks further clarity on actionable measures. Otherwise, in Japan, the Yen rose 7.3% with the Bank of Japan under pressure to raise rates.

• Global economy – US rates were unchanged at 5.5%. The USD remained firm. US inflation remained well behaved (CPI at 3.3% year on year). Non-farm payrolls rose 272k and the unemployment rate rose a touch to 4%. The market retained its view that there would be two rate cuts by year-end in the US. US Consumer confidence fell, retail sales softened, and housing activity data was weak. Despite revising up its inflation and wage forecasts, the European Central Bank cut rates 25bp to 3.75%. While in China, Fixed Asset Investment rose 4% in May with infrastructure and manufacturing continuing to offset the negative property trends. Property data in China continues to show broad weakness in sales, construction activity and home prices.

• Commodities broadly fell but Precious Metals rose – The CRB Index fell 4.3% and the LME (Base) Metals Index fell 5.8% dragged down by Aluminium (-10%). Steel making commodities suffered. Steel prices dropped 8%, Hard Coking Coal fell 7.5% and iron ore sank 5.4% to US$101/t impacted by soft Chinese property data and high Chinese (iron ore) port stocks. Oil dropped 4.5% and Lithium prices remained under pressure impacted by increasing supply and softening Electric Vehicle demand. Natural gas plummeted 21% and soft Commodities fell also. Gold bucked the trend rising 5.2% to US$2447/oz supported by a fall in bond yields, rising geopolitical tension and central bank buying.

• Earnings and valuations – In aggregate, ASX200 12-month-forward earnings were negative (-1.1%) with the Materials sector weighing. This implies that gains in the ASX200 have been driven by a further multiple re-rating. The ASX200 now trades on a price to earnings (PE) multiple of 17.1x and remains mildly expensive versus the long-term average levels (15x). As we enter the FY reporting season in August, this does leave the market vulnerable to any earnings disappointments. Seasonally August and September have experienced fewer positive returns in the equity market, and we are positioned as such. The 1-year forward Dividend yield on the ASX200 dropped to 3.7%. Globally, earnings expectations rose 1.4% driven by upgrades to Emerging Markets and the US offsetting falls in Europe.