EQT Monthly Market Summary March 2025

MARKET SUMMARY

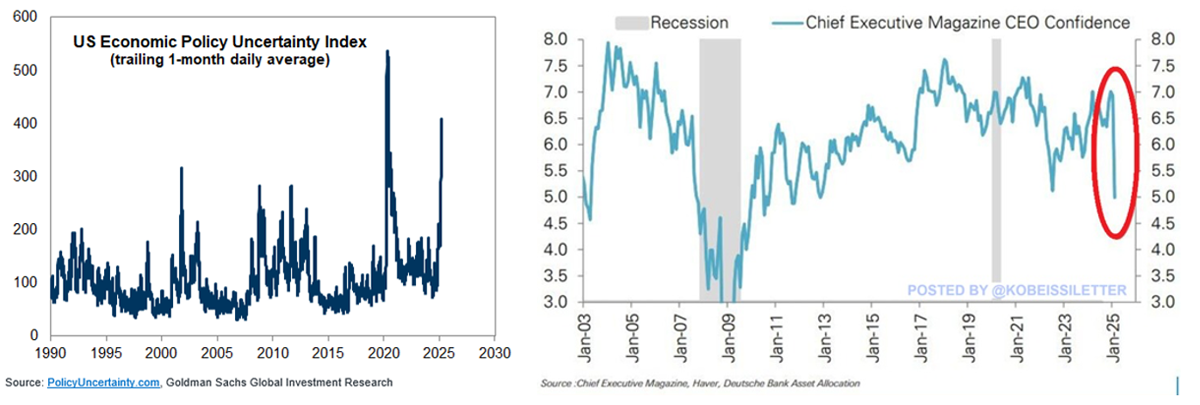

Markets don’t like uncertainty – The Trump trade appears to have reversed. The Trump administrations mixed messaging on tariffs is increasingly worrying corporates and investors alike. A risk-off tone reverberated through markets in March as investors reassessed the potential impacts of US tariff policies on global growth and corporate earnings. The risk of a global trade war, lower US growth and higher US inflation fuelled stagflation fears. Softening US economic data and deteriorating consumer and business sentiment weighed on the US corporate outlook. The charts below show how US economic uncertainty has soared and corporate confidence has fallen.

US equities led the declines - In local currency, the ASX200 -3.4% outperformed the US S&P500 (-5.8%) and MSCI World ex-Aust (USD) index (-4.13%). In AUD, the MSCI World ex-Aust index fell 4.67%. Markets with high technology weightings struggled. The ‘Magnificent 7’ slid 10%, Taiwan’s equity market fell 10%, while the US Nasdaq fell 8.1%. Weaker earnings growth among Mega Cap US tech companies along with increased competition from Chinese tech companies in the AI space has seen investors star to question the returns on major Tech companies’ high capex plans. Conversely, European markets relatively outperformed as did Asia-Pacific (ex-Japan) which only fell 0.4% helped by India (+5.8%) and China (+2%). Investors shifted funds from the US to Europe and China. Emerging Markets outperformed Developed Markets, while “Value” sectors outperformed “Growth”.

Defensive sectors were sought – The strongest performing sectors in the ASX200 were Utilities (+1.5%), Materials (-0.3%) and Consumer Staples (-1.5%). Defensive sectors fared well as did miners who benefited from rising commodity prices. Gold miners (+13%) were the standout. The worst performing sectors were Information Technology (-9.7%), Consumer Discretionary (-6.3%) and Property (-4.9%). Taking market capitalisation into account the key contributors to ASX were large gold miners (Newmont, Northern Star and Evolution), Telstra and Rio Tinto. Conversely, Macquarie Group, Commonwealth Bank, CSL, Goodman Group and James Hardie all weighed on the market. James Hardie dropped after announcing an acquisition of AZEK in the US for $8.75bn with investors questioning the price paid. Globally, Energy and Utilities performed best, while IT and Consumer discretionary sold off the most.

AREITS fell - Australian Real Estate Investment Trusts (AREITs) dropped 4.9% over the month. Goodman Group (GMG) weighed on the sector again falling 9.2% as data-centre related play were sold off on concerns of slowing hyperscaler capex. Ex-GMG the REITs fell 2.4%. Investors switched into defensive names such as non-discretionary retail and malls. In the office space, Japanese owned Daiburu acquired a Sydney premise for $600m on a 6% yield lending support to the struggling sub-sector. Transaction activity remains soft, however. Globally REITs fell 2.4% during the months with the Asia-Pacific region outperforming and Europe underperforming.

Bonds held ground – Australian bonds (Bloomberg AusBond Comp 0+Y index) gained 0.17%. Short-end bond yields fell in Australia, while 10-year bond yields rose 9bps to 4.38%. US 10-year bond yields were unchanged at 4.21%. German bund yields rose notably higher following the announcement of increased German government spending.

Australian credit spreads widened - Australian Credit (ex MBS) markets eked out gains of 0.28%. Over the month spreads widened by between 19-30bp depending on name and tenor. This widening is partly due to issuance fatigue (March and February were near record issuance months) and concerns over Trump’s tariffs and how that impacts global inflation, U.S. inflation and concerns over stagflation. Spreads have mean reverted to levels seen some 6 months ago. Currently spreads have the possibility to move another 10bp and if so, they would then be at a level close to the long-term average.

US economic growth fears increased - The US Federal Reserve held rates steady at 4.25-4.5%. Inflation rose 2.8% year-on-year in February. The US unemployment rate rose slightly to 4.1% and retail sales rose 0.2% on the prior month in February. US consumer confidence plummeted in March as concerns grew about DOGE related job cuts and tariff impacts on inflation. Manufacturing indices slipped while services measures rose slightly. Bloomberg surveyed economists downgraded their US GDP forecasts 0.3% during the month and the chances of a recession in the U.S. has moved from 20% to 35%. The USD fell against all major currencies. China manufacturing and services indices slightly rose, and housing related data stabilised. In Europe, German leaders have proposed a large fiscal package with a focus on defence and infrastructure spending. The ECB cut rates further (-25bps to 2.5%) during the month also.

Australian economy – Headline monthly CPI rose 2.4% (Feb) year-on-year, the unemployment rate remained at 4.1% and consumer confidence rose. Business confidence fell but conditions remained steady. House prices rose 0.4% in March, while sentiment toward buying a house also improved. Despite a concerning global backdrop, the outlook for the Australian economy appears to be turning more positive. The market continues to price in ~3 rate cuts this year. Our economy is likely to be less directly affected by US trade tariffs, consumption trends are slowly improving, the labour market remains tight, and inflation appears under control. A “pre-election” budget was also released during the month. Government spending is likely to remain supportive to the economy. The $A/$US rose slightly (+0.6%) to 62.47c.

Commodities: Gold shone – Despite fears of slowing global growth, commodities performed relatively well assisted by stimulus in China and Europe as well as a weaker US Dollar. Gold hit new highs rising 9.3% supported by ‘safe haven’ demand amidst rising geopolitical risks. Base Metals rallied (+3.6%) and oil rose 2.5%. Steel related materials fell (Iron Ore -1.7%, Coking Coal -18% and China rebar -2.2%).

ASX200 earnings - Consensus earnings revisions for the ASX200 remained negative (-0.4%) during the month impacted negatively by the Energy (-5.8%), Information Technology (-4%) and Industrials (-2.2%). Global earnings expectations rose 1% in March. Earnings growth in CY2025 is forecast to be ~6.1% for the ASX200 and 11.6% for the MSCI World. Despite the ASX200 Price-Earnings (PE) ratio falling, the ASX200 remains mildly expensive ending the month trading at a 1-year forward PE ratio of 16.9x (vs long term average of 15x). The 1-year forward ASX200 dividend yield has risen to 3.8% as dividends have remained steady. The US (S&P500) market is trading on 20.1x PE which is also high versus history.

Tactical positioning – From an asset allocation perspective we have been concerned about equity valuations at a time of increasing global risks. Accordingly within our asset allocation we have been underweight equities and overweight defensive assets such as Cash as we see strong risk-adjusted returns for traditional defensive assets. We continue to note that while macro factors are important, in more challenging economic conditions it is beneficial to focus on basic micro factors as to what makes a good business and investment. We believe that active management in the right areas can contribute to strong overall returns.