Major sector ETFS Ranked by 6 Month Returns

Source: Saxo Capital

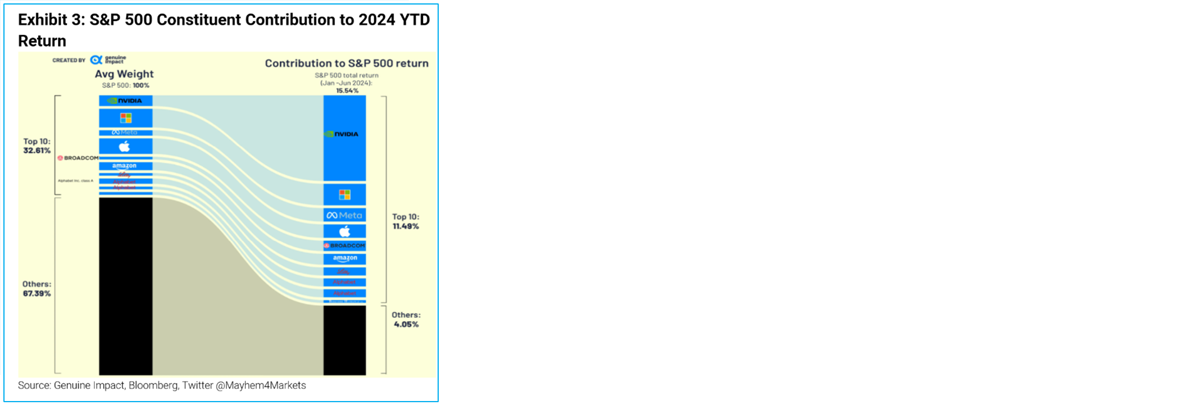

Broad Technology (VGT) and Communication Services (XLC) were the only two sectors to eclipse MSCI’s (ACWI) 12% return for the half year. The ten largest stocks in the S&P 500 have driven more than 70% of the index’s 2024 YTD return. More interestingly, an outsized portion of this is due to Nvidia’s rally alone with this stock appreciating 155% over the 6 month period on the back of exceptionally strong earnings growth - 208% revenue growth & 803% EPS growth (latest quarter). By and large most of the big tech names reported better than forecast earnings during the period, somewhat justifying their share price moves.

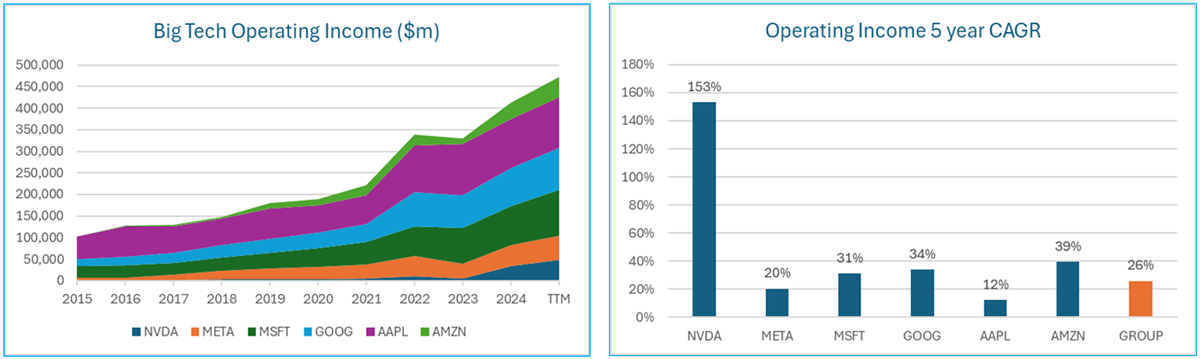

Big 6 Technology company operating income

Source: SeekingAlpha, Company filings

The key question for investors are can these businesses sustain such earnings growth and more importantly what will be the drivers of future growth?

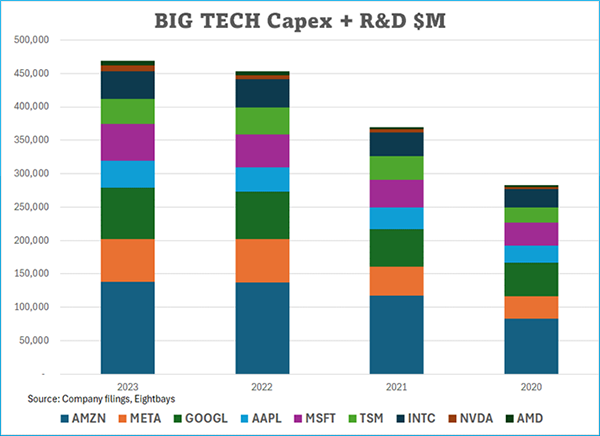

There are dynamics within the technology sector that we believe will support earnings growth for these business.The biggest single dynamic being the transition from general computing (CPU intensive) to parrallel computing (GPU intensive) for the delivery of machine learning and artificial intelligence functions such as those provided by Large Language Models or LLMs. This revolution in the global compute environment requires considerably more IT expenditure. We note that capex and R&D budgets were increased substantially in the most recent quarterly reports by all the major technology businesses.

“We anticipate our overall capital expenditures to meaningfully increase year-over-year in 2024, primarily driven by higher infrastructure CapEx to support growth in AWS, including generative AI.” Andy Jassy CEO Amazon.com

This first phase of expenditure is largely absorbed by the hardware providers ie data centres (Cloud Service Providers or CSPs), semiconductor and memory chip manufacturers and suppliers of network equipment. The next area of growth will be in Ai enabled devices such as PCs, laptops and smart phones. Most analysts are forecasting a strong upgrade cycle in such devices. Software development for Ai related use cases is likely to become an important and fast growing industry.

“collectively, the companies on the AI 50 List have raised a total of $34.7 billion in funding.” Forbes Magazine

We are already witnessing developments across a broad range of industries from drug development to legal services. It is important to remember that the major driver of the spend is, and will continue to be, to improve customer expererience, data collection and management, business efficency and returns to the end user base while maintaining a competitive position.

Industry ETF mid-year review

The US industry ETF market was valued at US$1.12tr as at June 2024 ($1.0tr at Dec 2023). Industry ETFs represent about 17% of all US equity ETFs ($7.1 tr).

The US equity ETF market had a strong six months both in terms of funds flow and performance. Only one sector delivered negative returns and that was real estate (-6%). However, what is interesting is that only two sectors outperformed the MSCI benchmark (+12%) - Technology (+24%) and Communication Services (+19%). Net funds flow in the first six months of 2024 was $270bn and a record 190 ETFs were listed. The total market value of these new listings was $12bn. Eagle Capital Select Equity ETF was the largest listing ($1.98bn) and Global X Russell 2000 ETF was next largest ($1.2bn). The smallest listing was the Themes Silver Miners ETF ($509k). Most listings were smart beta/active ETFs together with leveraged strategies and as such the expense ratios of these ETFs are typically much higher than those in our investment universe.