MARKET SUMMARY

Share markets fell – Tariff uncertainty, reporting season and weaker US data occupied the minds of investors in February. In local currency, the ASX200 (-3.8%) underperformed global equity markets. The MSCI World ex-Aust index fell -1.15% (in USD terms), but in $A terms global equities only fell 0.36%. MSCI China rallied 11.5% as investors bought Chinese tech stocks, European markets (+3.4%) rose on hopes of peace deals, while Japanese equities (-6.1%) were negatively impacted by US tariff talk, rate hike expectations, increasing inflation and a rising Yen. A rotation out of US tech continued (Magnificent 7 down 7.1% and Nasdaq down 3.9%), with the US underperforming the MSCI World for the 3rd month in a row..

Defensives outperformed – Within the ASX, ‘Defensive’ sectors outperformed as investors sought safety. The best performing sectors in the ASX200 were Utilities (+3.2%), Communication Services (+2.6%) and Consumer Staples (+1.5%). Conversely, the worst performers were Information Technology (-12.3%), Healthcare (-7.7%) and Property (-6.4%). The banks (-5.2%) delivered their worst monthly return in more than two years. Taking market capitalisation into account the key contributors to ASX gains were Computershare, Telstra and Brambles while National Australia Bank, Goodman Group, CSL and Westpac all weighed on the market. Globally, Consumer Staples, REITs and Financials performed best.

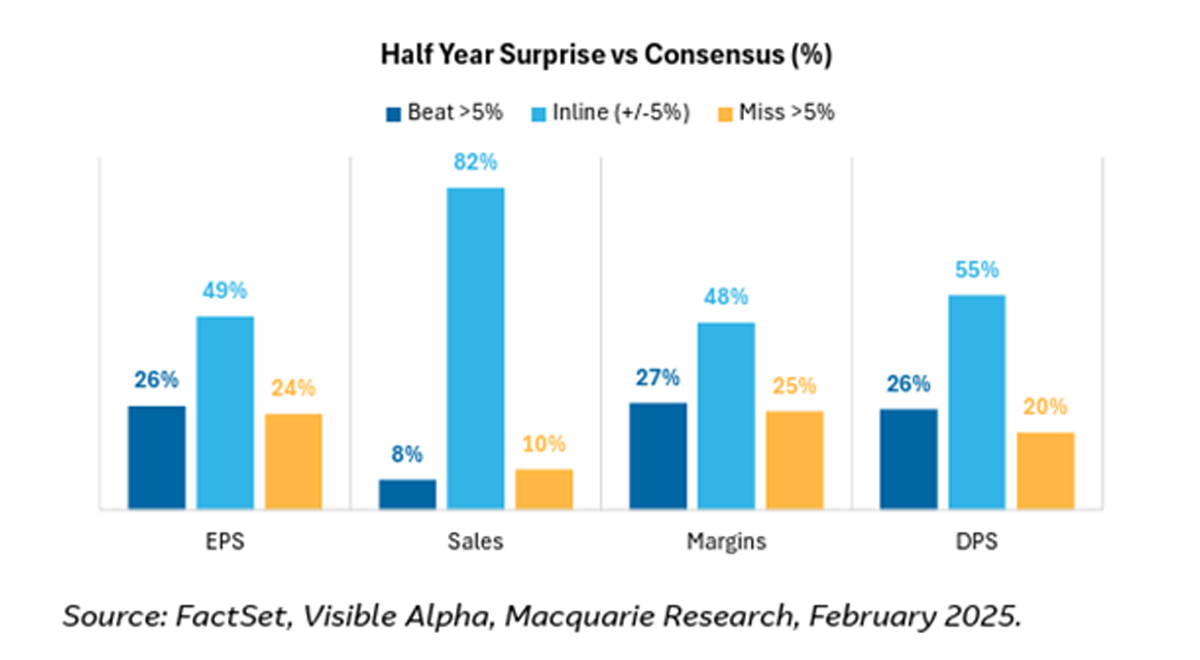

Reporting Season – In the US, reporting season delivered results broadly in-line with expectations. Earnings growth was stronger than expected, but companies were not rewarded for their beats and forward earnings guidance for 2025 was relatively subdued with estimates revised lower. Relative to recent reporting periods the Magnificent 7 didn’t surprise as positively. In Australia, listed corporates delivered another solid set of numbers with slightly more earnings (EPS) and dividend (DPS) beats than misses. Share price volatility was a notable feature with high valuations leaving little room for disappointment. While guidance surprises were balanced, aggregate earnings and dividends were revised slightly lower (down 1-2% for FY25 and FY26) and was broad-based in nature. The ASX200 performed more poorly in the second half of the month as result quality worsened..

AREITS fell as Goodman Group raised capital – Australian Real Estate Investment Trusts (AREITs) dropped 6.1% over the month impacted by the surprise $4bn equity raise conducted by Goodman Group (GMG) to fund its expanding Data Centre development pipeline. GMG fell 14.1%. Scentre Group’s (SCG) soft result and guidance also impacted. Within the different sub-sectors, residential sales picked up in 4Q, Retail malls recorded solid metrics including strong occupancy levels, Office trends stabilised albeit remain mixed, and Industrial sector growth remains strong but is slowing. In contrast, global REITs rose 3%.

Bonds rallied – Global trade uncertainty and weaker US economic data saw investors buy bonds despite increasing US inflation expectations. Australian bonds (Bloomberg AusBond Comp 0+Y index) gained 0.93%. Australian 10-year bond yields fell 14bps to 4.29%, while US 10-year bond yields dropped 33bps to 4.21%. Credit (ex MBS) markets continued their solid gains rising another 0.79%.

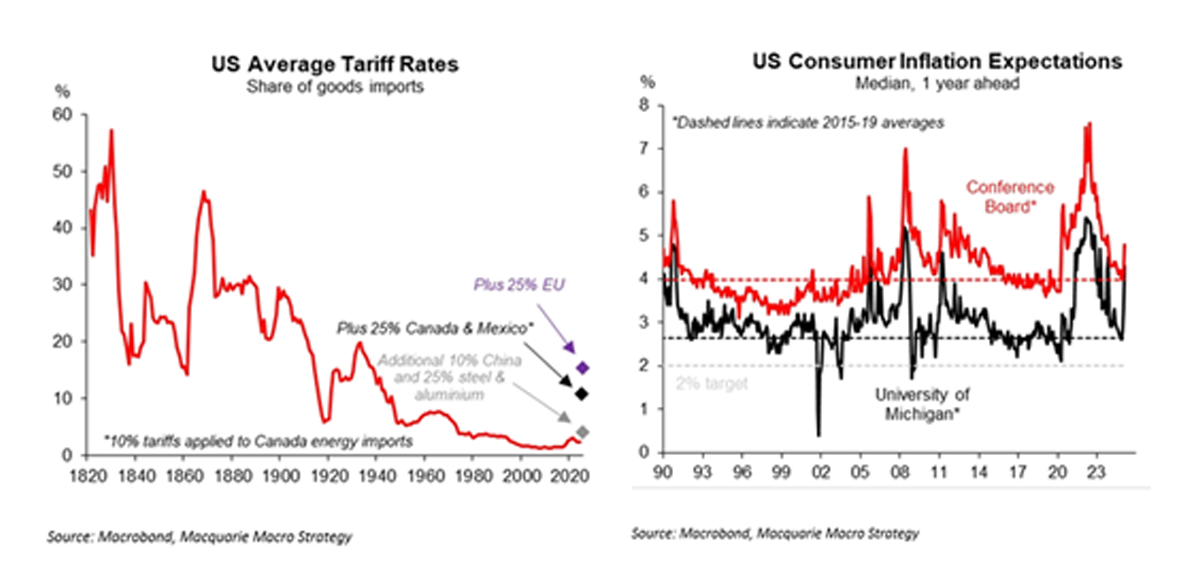

Global Economy - Recent inflationary concerns were reinforced in February as US inflation expectations increased over the short and medium term. The US economic surprises index turned negative after poor retail sales and consumer confidence numbers were released. Tariff flip-flops are leading to increased uncertainty in the global marketplace and the US Department of Government Efficiency (DOGE) has initiated several measures to reduce federal spending including cuts to healthcare and staffing reductions. The USD fell 0.7%. Incremental news out of China was marginally positive with manufacturing data improving and measures to support the real estate market slowly gaining traction.

Australian economy – The RBA cut rates 25bp to 4.1% in what many described as a ‘hawkish’ cut. Jobs growth remains solid (+44k in January), while inflation figures were broadly in-line (+2.5% year-on-year in January) and wage growth is slowing. House prices rose 0.3% month-on-month after three months of declines in response to the rate cut. The $A/$US fell slightly (-0.1%) to 62.09c. Over the ditch, the Reserve Bank of NZ cut rates 50bp to 3.75% with more cuts expected.

Commodities – Base Metals rallied (+2.9%) driven by gains in Copper. Gold also gained (+2.1%), while oil and iron ore fell 4% and 2% respectively. Natural gas soared 33%, soft commodities (Agriculture) fell, Thermal Coal sank 18% and Alumina dropped 10%.

ASX200 earnings - Consensus earnings revisions for the broader ASX200 reversed some of the positive momentum seen at the end of 2024 falling 1.3% in February impacted negatively by IT and Materials/Energy. Earnings growth in CY2025 is forecast to be ~6.9% for the ASX200 and 9.4% for the MSCI World. The ASX200 remains mildly expensive ending the month trading at a 1-year forward Price-Earnings (PE) ratio of 17.7x (vs long term average of 15x). The 1-year forward ASX200 dividend yield is sitting at ~3.5%. The US (S&P500) market is trading on 22x PE which also appears stretched.