MARKET SUMMARY

• Share markets rose strongly supported by the “Trump trade” - In local currency, the ASX200 rose +3.8% outperforming European and Asian markets but underperforming the US S&P500 (+5.9%) and global equities (MSCI World ex-Australia index +4.5%). US equities were helped by a broadening in market returns as investors priced in benefits from deregulation and reflationary policies under a Trump government. In $A terms global equities rallied an even more impressive 5.2%. Developed Markets outperformed Emerging Markets significantly. Emerging markets (-1.9%) struggled impacted by a strong US dollar and increasing US tariff threats.

• Bonds rose, but only late in the month – After a major bond sell-off in October, Australian bonds (Bloomberg AusBond Comp 0+Y index) gained 1.14% as bond yields dipped. Australian 10-year bond yields fell 16bps to 4.34%, while US 10-year bond yields fell 11bps to 4.17%. Most of the rally occurred toward the end of the month. Credit markets remained broadly supportive.

• ASX sector returns – The Industrials (+5.9%) drove the ASX200 higher. The best performers for the month were Information Technology (+10.5%), Utilities (+9.1%) and Financials ex property (+7.0%). Offshore Financials gained strongly fuelled by US banks who are likely to benefit from increased deregulation in the US market. The worst performers were Materials (-2.6%) and Energy (-0.7%) as investors are concerned a faltering Chinese economy will be further negatively impacted by US tariffs. Taking market capitalisation into account, the top five contributors to the ASX200 were Commonwealth Bank (+89.2bps), Wesfarmers (+17.4bps) and Westpac (+14.4bps). Conversely major resource companies and CSL weighed on the market. Australian property securities gained 2.48% assisted by a pull-back in bond yields, while large caps outperformed small caps locally.

• ASX company updates – Australia’s AGM season saw ~80% of companies maintain guidance. Bank updates were viewed more positively while retailer’s earnings were revised down. Tech companies such as Xero and Technology One delivered solid updates. Qantas’ share price continued to rise as industry condition are viewed as broadly supportive. Amcor (AMC) and Berry Group announced a merger agreement bringing together two complementary businesses in a strongly earnings accretive deal. IAG agreed to buy 90% of RACQ’s insurance business which looks like s smart deal.

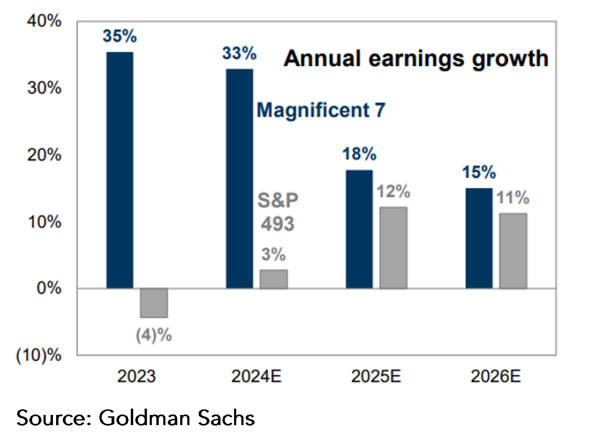

• US Q3 results - In the US, 3rd quarter results were again sound. The “Magnificent 7” delivered ~25% year-on-year earnings growth – albeit the pace of growth is decelerating. US corporate growth in 2025 could be supported by a broadening across a range of sectors. Goldman Sachs expects the earnings growth premium (of the Magnificent 7 vs the other 493 companies in the S&P500) to narrow sharply in 2025. Meanwhile, European corporates face greater earnings headwinds.

• Global Economy: The US remains the growth engine – The US Federal Reserve cut rates 25bp to 4.5-4.75%. However, US inflationary data proved sticky and economic data remained robust, pushing out expectations for the next rate cut by the Federal Reserve as well as the depth of the cutting cycle. US consumer sentiment hit a 7-month high, while the services sector expanded at the fastest pace in two years. US household balance sheets remains in good shape and consumption in the US is expected to remain a key driver of growth in the 4th quarter. Higher US inflation expectations from Trump tax cuts, tariff pass-through and lower immigration has increasingly been priced in. The US dollar continued to rise supported by the “Trump trade” weighing down most major currencies ($A/$US fell 1.1% to 65.12c). The exception was the Japanese Yen after the Bank of Japan Governor gave a hawkishly viewed interview. Chinese PMI and factory activity data slightly improved, while home prices remained under pressure. The European Central Bank warned of the negative impacts of tariffs in global growth. Eurozone economic activity continues to lag the US. In the meantime, the Russia – Ukraine conflict escalated during the month.

• Australian economic activity - The RBA held the cash rate steady at 4.35%, but investors pushed out their forecasts for a rate cut in Australia to May 2025 following another solid labour market print, higher “trimmed mean” inflation data and some hawkish commentary in the RBA minutes. Consumer confidence in Australia is starting to tick higher. However, there were some signs that inflation should continue to moderate in Australia with housing inflation, retail discounting and softer wages all helping.

• Commodities – Natural gas prices soared 24%, alumina continued its stella run rising another 10%, Iron ore gained 2% while Lithium finally caught a bid rising 14%. Conversely the LME (base) metals index fell 3%, gold dropped 3.7% and oil dipped 1%.

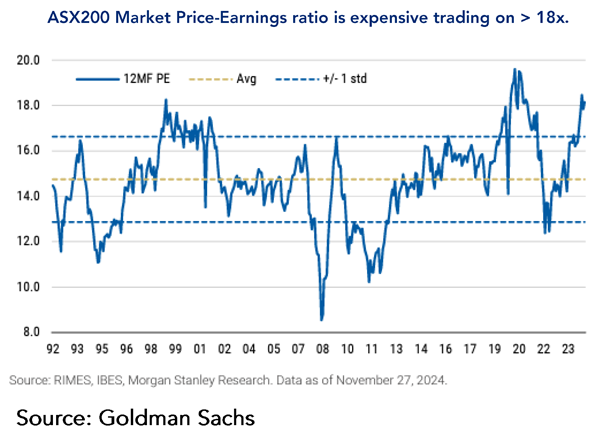

• ASX200 Earnings and valuation - In aggregate, ASX200 earnings remained broadly unchanged as Utility sector upgrades offset Consumer Staple sector downgrades. ASX200 valuation levels remain challenged at 18.4x forward earnings vs the long-term average of 15x. Global earnings expectations were steady in November.

• Outlook – We recently published our 2025 market outlook. In our view much of the good news anticipated for CY25 appears priced into market expectations. Markets remain primed for a Santa Claus rally, but key concerns for many investors remain elevated valuation levels and implications from the US election and new policies on global growth.

DOWNLOAD REPORT

Learn about the latest market trends and insights in our Monthly Market Review series.