MARKET SUMMARY

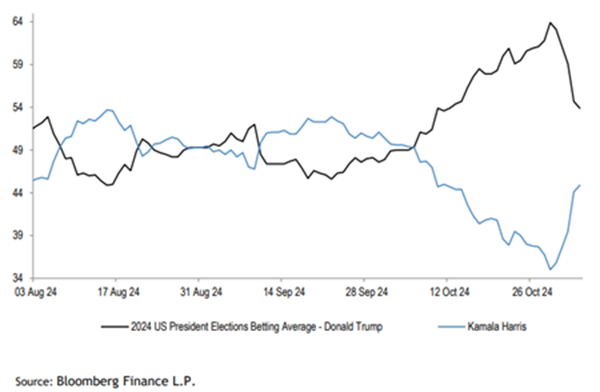

• The ‘Trump Trade’ impacted markets in October – During the month investors moved to price in not only a Trump election win, but a “Red sweep”. Bond yields rose and the US Dollar soared as investors braced for higher fiscal spending (increased US treasury issuance), higher tariffs (inflationary) and lower taxes.

US Election - Donald Trump and Kamala Harris betting odds

• Share markets took a breather - In local currency, Australian equities (ASX200 -1.3%) outperformed global equities (MSCI World ex Aust -1.65%). Japan’s Nikkei rose 3.1% while the US S&P500 fell 0.9%, Asia-Pacific ex Japan dropped 4.2% and Europe sank 3.3%. However, given the large fall in the $A/$US during the month (-4.8%), in $A terms global equities rallied 3.92%. ASX small caps rose 0.8% while Australian property securities fell 2.5% negatively impacted by higher bond yields.

• Bonds fell as investors repriced the outlook for interest rates – Australian bonds (Bloomberg AusBond Comp 0+Y index) fell 1.88% as bond yields moved higher. The value of Bonds falls as yields rise. Australian 10-year bond yields rose 53bps to 4.5%, while US 10-year bond yields rocketed 50bps higher to 4.28%. Better than expected US economic data, rising geo-political risks and a higher chance of a Trump election victory all contributed to higher yields. Cash returns rose 0.37% month on month.

• ASX Sector returns – The Gold sector outperformed rising 10.3%. Financials ex property (+3.3%) were also a standout sector supported by the major banks. Hub24 rallied 18% and Block Inc soared 16%. Conversely, the worst performers were Utilities (-7.2%), Consumer Staples (-7.0%) and Materials (-5.2%). Consumer Staples were impacted by a poor trading update from Woolworths. Mineral Resources dropped 24% and Wisetech fell 14% sullied by governance issues. Taking market capitalisation into account, the major banks were the key contributors. Conversely, the biggest drags on the index were the major miners (BHP and Rio Tinto) and Consumer stocks (Woolworths and Wesfarmers)..

• Company updates – In Australia, AGM season so far has been slightly more negative than positive. Financial company updates have been most resilient, while consumer related sectors have been softer. Bluescope Steel, building materials company Reece Limited, and Woolworths have disappointed. Travel companies Web Travel and Flight Centre fell 45% and 28.5% respectively in October. In the US and Europe, 3rd quarter earnings results have been broadly solid helped by Financials, technology, and healthcare stocks.

• Macro-economic news – Australian employment rose 64k month-on-month (mom) above expectations (+25k) due to public sector hiring. September retail sales rose 0.1% mom and house price growth softened. Markets are pricing in a 25bps rate cut in the US in November, while the RBA is expected to remain on hold until next year. Economic surprises in the US were (on average) positive in October. US payrolls (jobs) rose solidly again. Continued news out of China around stimulus measures were outlined with more measures to be announced after the US election result. The European Central Bank cut rates by 25bps.

• Commodities were mixed – Gold prices rose 4% to $US2750/oz supported by central bank buying and geo-political tensions. Oil (+2%) also rose marginally. Base Metals fell 2.8% and iron ore prices sank 7% to $US105/t. The lithium sector experienced some M&A, while big tech companies appear to be underwriting the nuclear sector with Amazon exploring development of a small modular nuclear reactor to power sites.

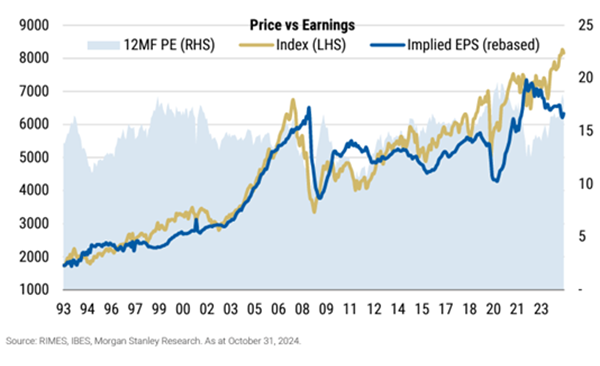

ASX200 Price vs forward Earnings-per-share (EPS)

DOWNLOAD REPORT

Learn about the latest market trends and insights in our Monthly Market Review series.