MARKET SUMMARY

• Stocks surge higher on US Fed rate cuts and Chinese stimulus – In local currency terms, the ASX200 (+3%) outperformed the US S&P500 (+2%), the UK FTSE 100 (-1.7%) and the Japanese Nikkei 225 (-1.9%) during the month. Asia-Pacific ex Japan rose 7.5% boosted by a surging Chinese equity market (Shanghai Composite) that exploded +17.4%. Notably, in AUD terms the MSCI World ex Australia Net Total Return Index fell 0.9%. Australian property securities (AREITs) gained 6.58% supported by rate cuts, while ASX Small Ordinaries rose 5.1% buoyed by Chinese stimulus and risk-on sentiment.

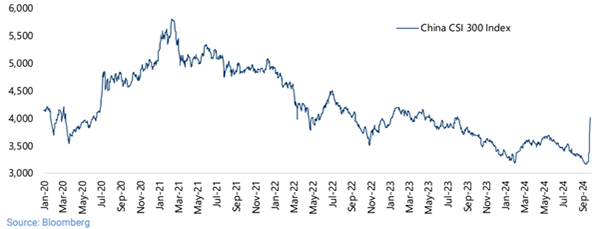

The Chinese share market surged in September after larger than expected stimulus measures.

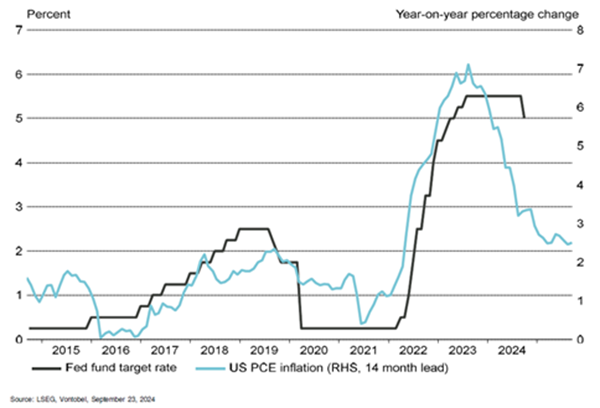

• Two major events shaped September – Historically September has been a poorer returning month for equity markets. However, two major events helped spur a rally. Firstly the US Federal Reserve (Fed) surprised markets by cutting rates by 50bp giving investors greater confidence the battle against inflation had been won, and that the Fed would now turn their attention to the labor market, easing recession fears. Secondly, Chinese authorities launched larger than expected monetary and fiscal policy stimulus – the most significant since 2015 - to support the weakening economy.

• Sector and stock contributors – In Australia, the best performing sectors for the month (total returns) were Materials (+13.1%), Information Technology (+7.4%) and Property (+6.6%). Miners such as Mineral Resources (+30%), Sandfire Resources (+25.6%) and South32 (+22%) rose strongly. The worst performers were Healthcare (-3.2%), Consumer Staples (-1.7%) and Communication Services (-0.9%). Banks were used as a funding source to buy the miners. Taking market capitalisation (size) into account, the major contributors to the market were the big miners, Goodman Group and Macquarie Group. Conversely, stocks that dragged on the market included CSL, CBA, Woodside Energy, National Australia Bank and Wesfarmers. Globally, Utilities, Consumer Discretionary and Materials performed best.

• Bonds rallied – The Bloomberg AusBond Comp 0+Y rose 0.31%. US 10-year bond yields fell 12bp to 3.78%, while Australian 10-year bond yields remained steady at 3.97%. Australian credit markets rose 0.54%.

• Australian Economy – The RBA left the cash rate unchanged at 4.35%. Economic data remains subdued. August inflation (CPI) slowed to 2.7% year-on-year in line with expectations. The RBA is set to lag global central banks cutting interest rates with many expecting the first cut in December or February.

• Global Economy – Globally, services continue to outperform manufacturing sectors. As mentioned, the US Federal Reserve cut rates 50bp to 4.75% and are expected to cut again in November. US CPI printed +2.5% year-on-year. The US Dollar (USD) fell against most currencies. The AUD/USD rose 2.2% to 69.13c. US consumer confidence fell on a poor outlook for the jobs market. US Election polls moved toward the Democrats who are less vocal on protectionist measures. European data (Output and new orders) have weakened recently. .

The US Federal Reserve cut by 50bp in September with more cuts expected to come.

• Commodities mostly rallied – The lower USD, Fed rate cuts and Chinese stimulus sent most commodities higher. Natural gas soared 37%, Iron ore rose 9% to US$113/t, Gold rallied another 5.2% to US$2634/oz and the LME (Base) Metals Index rose 6.1%. Conversely, oil (WTI) prices continued to fall, dropping another 7.3% to US$68/bbl while Coking Coal prices fell by 20%.

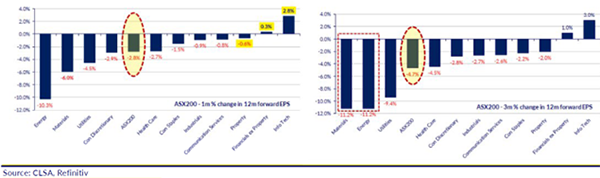

• Earnings and valuations – ASX200 Consensus earnings were revised down (-2.8%) again during the month driven by downgrades to the Energy, Materials and Utilities sectors. Conversely, global equity earnings were revised marginally higher in September. ASX200 earnings are currently expected to grow by ~2.5% in FY25 – well below international equities - with industrials better placed.

S&P/ASX200 Sectors - 1 month and 3 month changes to 12 month forward Earnings per share

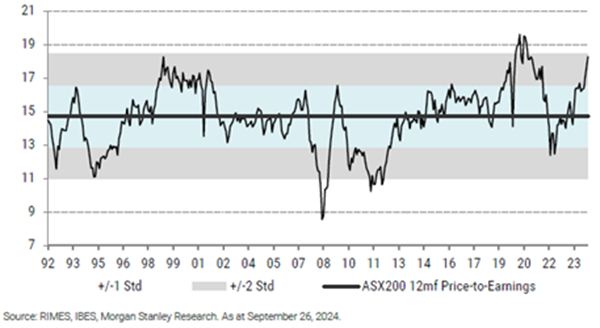

• Equity valuations remain expensive – While equity markets have rallied, earnings have not risen by the same amount, leading to a re-rating of valuation multiples which now look stretched. We remain concerned that slowing economic growth and rising geopolitical risks may not be adequately priced into equity markets. The ASX200 trades on a price to earnings (PE) multiple of 18.2x, a 21% premium to long-term average levels (15x). As shown above, earnings have been revised 4.7% lower over the last three months. International equities are trading on ~20.7x FY25F price-earnings ratio while offering earnings growth of ~12% and a dividend yield of 1.8%. US equities have been supported by mega-tech names while the outlook for broader sector participation appears more optimistic as rate cuts filter through the economy.

ASX200 12 month forward Price Earnings (PE)

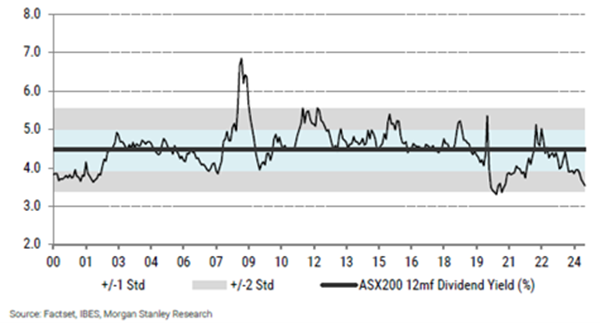

• ASX Dividend yield also indicates the market is expensive - The 1-year forward Dividend yield on the ASX200 is 3.5% - which is below the Australian 10-year bond yield. The ASX200 Dividend yield has fallen as the market has rallied but the outlook for dividends has been revised lower.

ASX200 12 month forward Dividend Yield

Learn about the latest market trends and insights in our Monthly Market Review series.

Download Report